Some Ideas on Estate Planning Attorney You Should Know

Some Ideas on Estate Planning Attorney You Should Know

Blog Article

The smart Trick of Estate Planning Attorney That Nobody is Talking About

Table of ContentsThe Definitive Guide to Estate Planning AttorneyIndicators on Estate Planning Attorney You Should KnowEstate Planning Attorney Fundamentals ExplainedWhat Does Estate Planning Attorney Mean?

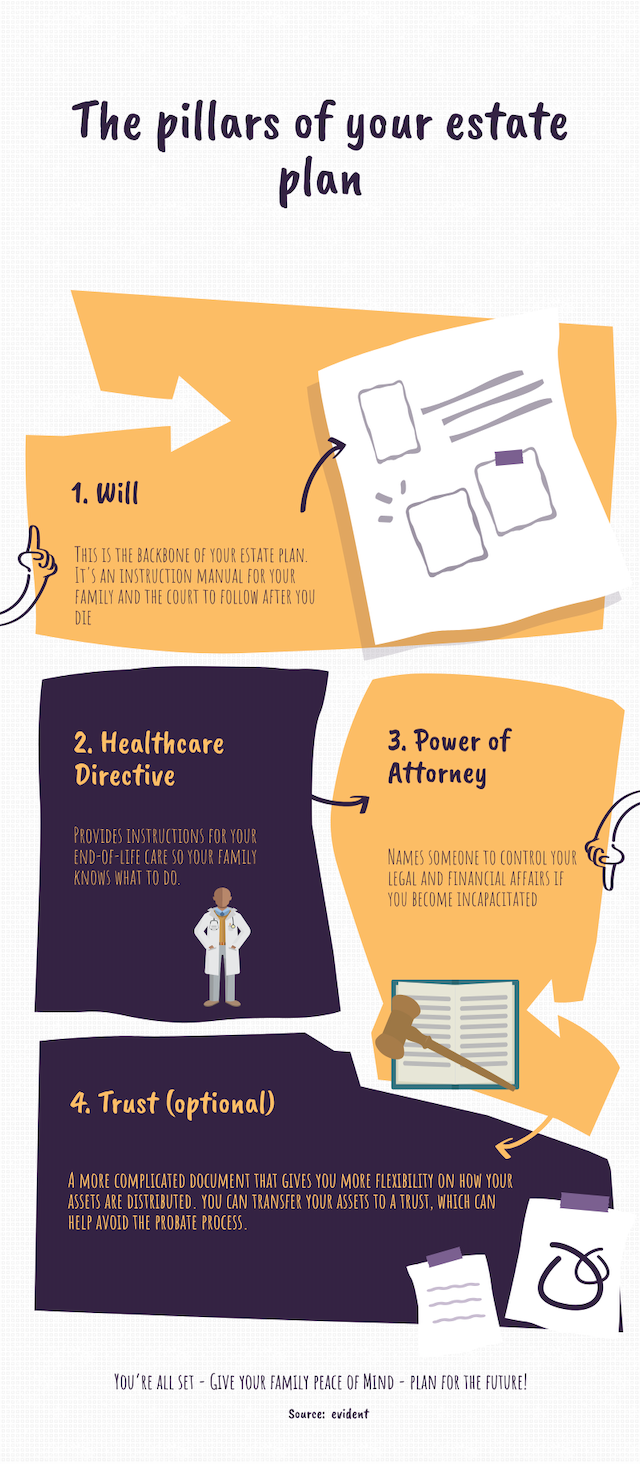

Estate preparation is an action strategy you can utilize to determine what takes place to your assets and commitments while you're to life and after you die. A will, on the various other hand, is a legal paper that lays out exactly how properties are distributed, who looks after youngsters and pets, and any kind of various other wishes after you pass away.

Insurance claims that are declined by the executor can be taken to court where a probate judge will have the final say as to whether or not the case is legitimate.

5 Simple Techniques For Estate Planning Attorney

After the stock of the estate has been taken, the worth of assets determined, and tax obligations and financial obligation paid off, the executor will then look for authorization from the court to distribute whatever is left of the estate to the beneficiaries. Any estate tax obligations that are pending will certainly come due within nine months of the day of fatality.

Each specific places their possessions in the count on and names a person besides their spouse as the beneficiary. A-B trust funds have become much less preferred as the estate tax exception works well for the majority of estates. Grandparents might move possessions to an entity, such as a 529 strategy, to support grandchildrens' education and learning.

Rumored Buzz on Estate Planning Attorney

Estate planners can deal with the contributor in order to minimize taxed income as an outcome of those payments or develop techniques that take full advantage of the result of those contributions. This is an additional technique that can be used to limit death tax obligations. It involves an individual securing in the present worth, and therefore tax liability, of their home, while associating the value of future growth of that resources to one more person. This method involves cold the value of a property at its value on the date of transfer. Appropriately, the amount of potential capital gain at fatality is also iced up, enabling the estate organizer to approximate their prospective tax obligation upon fatality and much better plan for the settlement of income taxes.

If enough insurance coverage proceeds are available and the policies are appropriately structured, any type of revenue tax on the considered dispositions of properties complying with the death of a person can be paid without turning to the sale of possessions. Proceeds from life insurance policy that are received by the recipients upon the death of the guaranteed are normally income tax-free.

There are particular records you'll need as part of the read more estate preparation procedure. Some of the most typical ones include wills, powers of attorney (POAs), guardianship classifications, and living wills.

There is a misconception that estate planning is only for high-net-worth people. Estate preparing makes it easier for people to determine their dreams prior to and after they die.

Estate Planning Attorney for Dummies

You must start intending for your estate as quickly as you have any measurable asset base. It's a continuous process: as life progresses, your estate strategy ought to move to match your conditions, in line with your brand-new goals.

Estate preparation is commonly considered a device for the well-off. That isn't the case. It can be a valuable method for you to handle your possessions and obligations prior to and after you die. Estate planning is likewise a fantastic way for you to lay out prepare you could check here for the care of your minor kids and pet dogs and to detail your yearn for your Website funeral service and favorite charities.

Applications must be. Eligible candidates that pass the test will be formally accredited in August. If you're eligible to sit for the exam from a previous application, you may submit the short application. According to the rules, no certification shall last for a period much longer than five years. Locate out when your recertification application is due.

Report this page